Bitcoin: A hedge for centralized banking risk

Bitcoin: A hedge for centralized banking risk

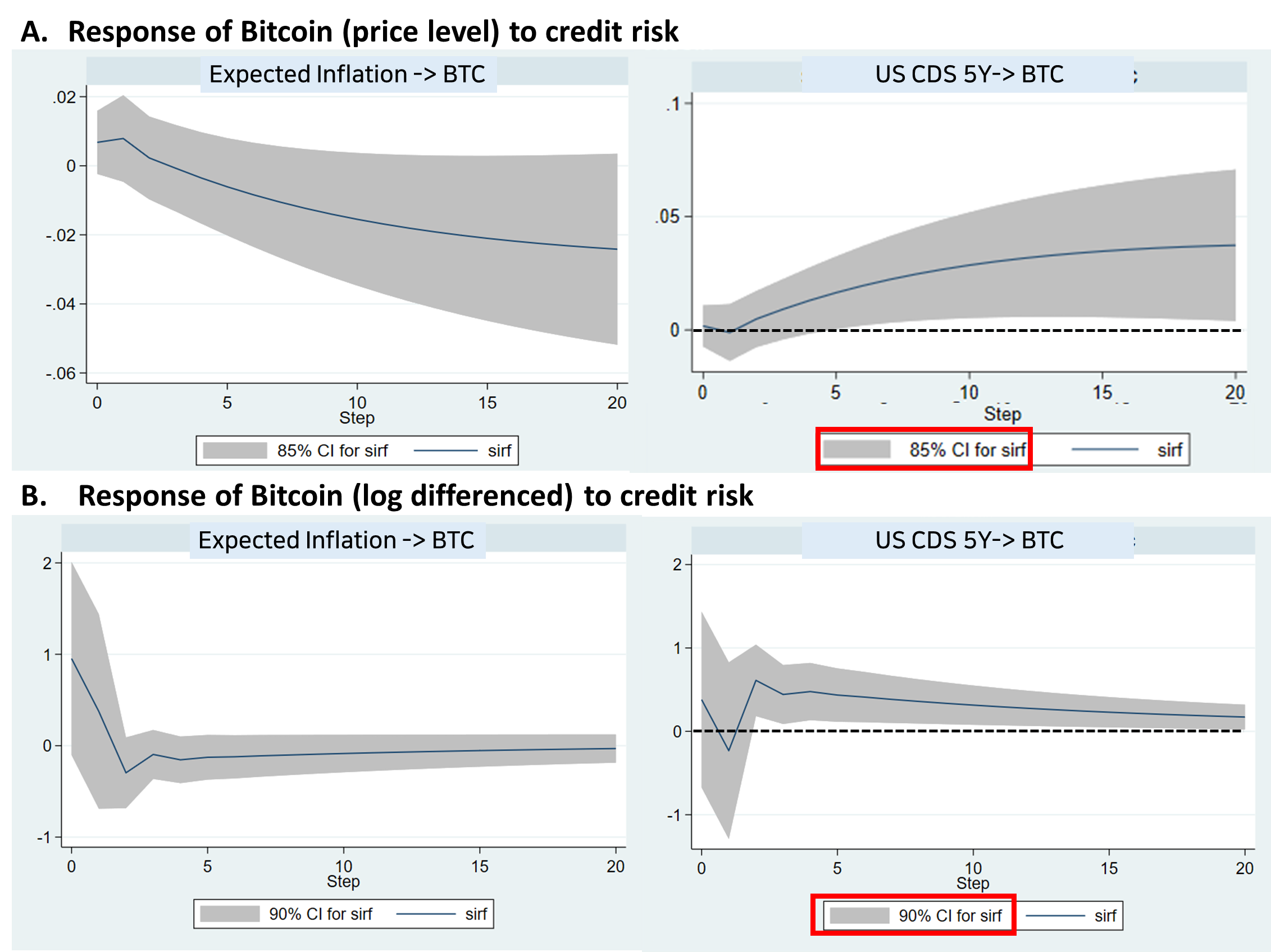

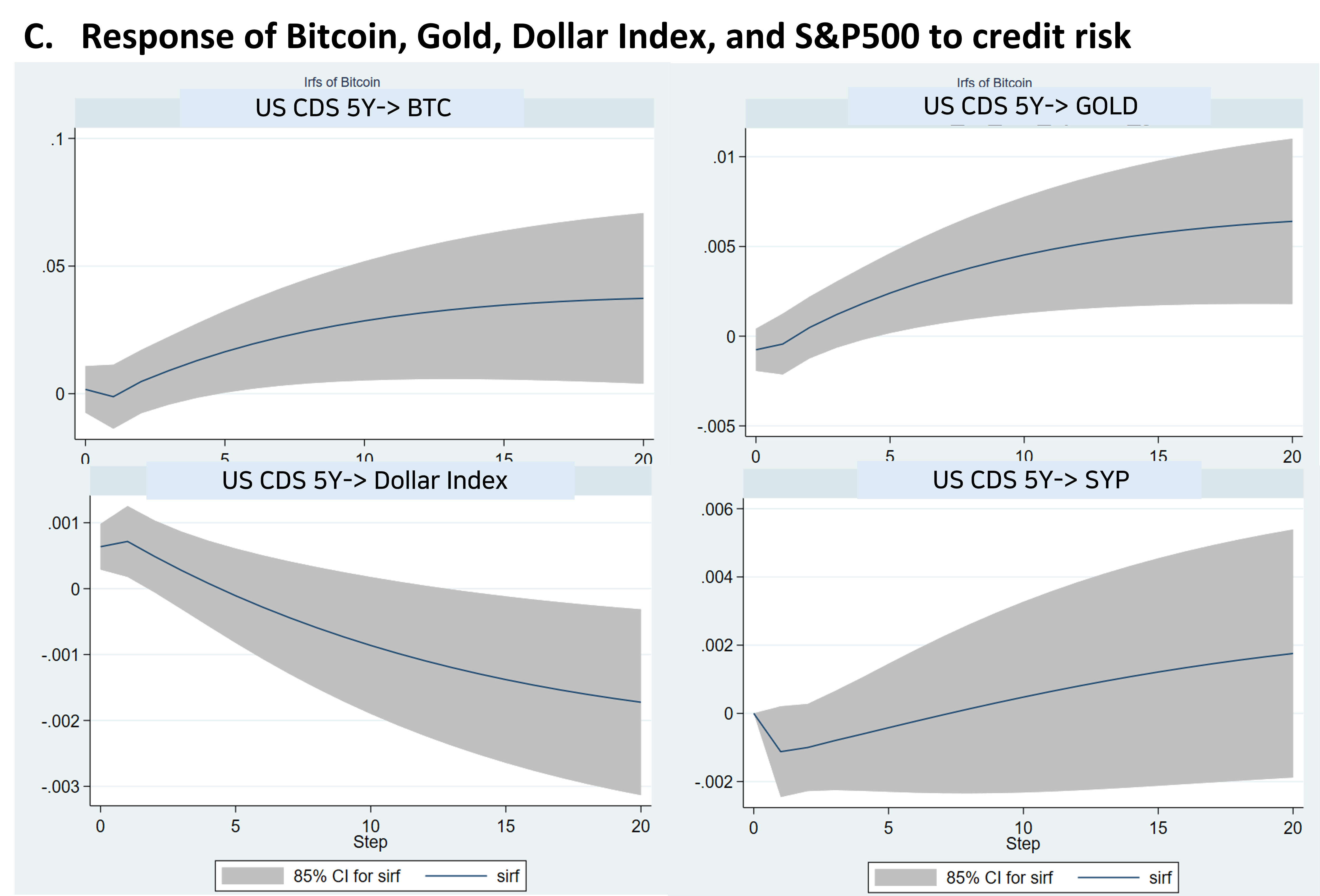

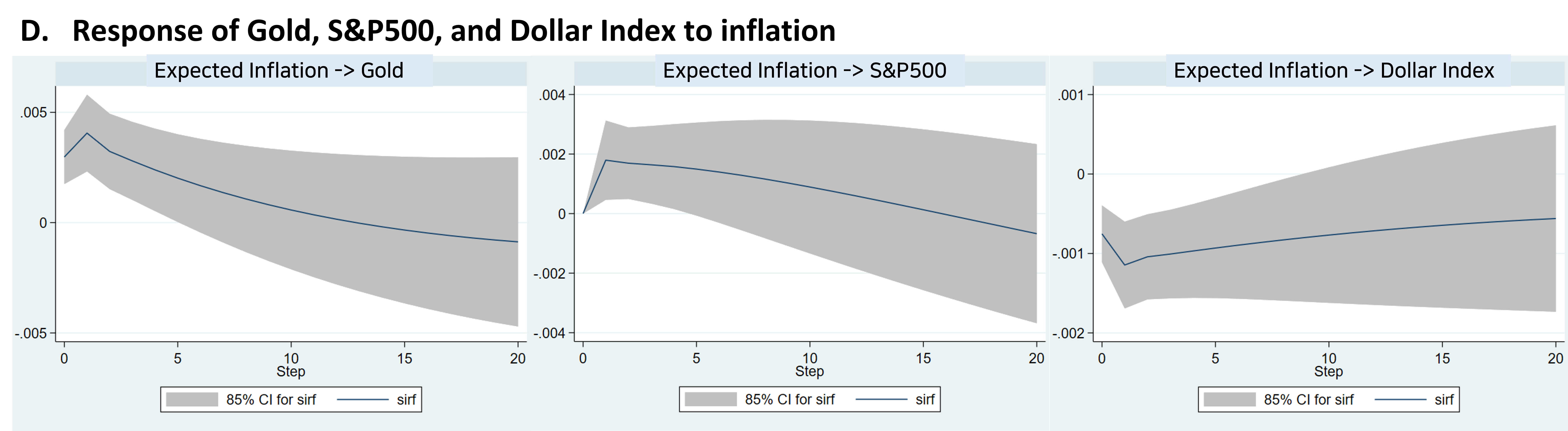

The reaction of crypto currency towards the failure of traditional banks (SVB and Signature Bank) arouse the idea that crypto currency could become an alternative towards centralized banking risks. We provide a new prospective on the controversial debate whether crypto currency could perform as a hedging asset. By testing bitcoin prices on credit default swap prices using the VAR model, we conclude bitcoin and gold outperforms dollar and stock in hedging credit risk. When we run VARs with log differenced variables the long-term relationship is significant at the 90% level. When we use price level variables, the results hold at the 85% level. Therefore, we conclude bitcoin could be a long-term alternative to hedge the credit risk from centralized financial institutes.

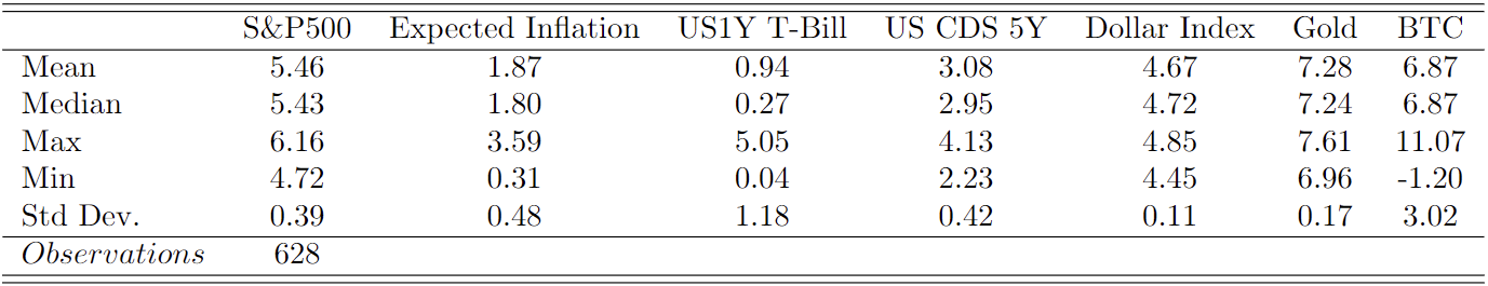

All variables are logged except expected inflation and treasury bond yields.

All variables are logged except expected inflation and treasury bond yields.

We use weekly data from year 2011 to 2023. Use 7 variables. Expected inflation, US 1 year treasury bond yield, US 5-year credit default swap, dollar index, Gold futures, and Bitcoin price. For stock market prices we use S&P 500 index fund prices.

Expected inflation: we employ (5-year nominal treasury yield – 5-year TIPS yield). 5 year US credit default swaps are measured in Euro.

For the Cholesky identification assumptions, we assume a contemporaneous effect in the order of Expected inflation >

1 year US Treasury bond yield > US credit default swap rates > Dollar Index.

We use weekly data from year 2011 to 2023. Use 7 variables. Expected inflation, US 1 year treasury bond yield, US 5-year credit default swap, dollar index, Gold futures, and Bitcoin price. For stock market prices we use S&P 500 index fund prices.

Expected inflation: we employ (5-year nominal treasury yield – 5-year TIPS yield). 5 year US credit default swaps are measured in Euro.

For the Cholesky identification assumptions, we assume a contemporaneous effect in the order of Expected inflation >

1 year US Treasury bond yield > US credit default swap rates > Dollar Index.